4 GIS Use Cases for Insurance Technology

Insurance Technology Trends for Mapping Risk

All you hear today is that insurance companies can save you more on insurance. But how can they do this? It’s partly because insurance companies can better assess risk with location intelligence as an insurance technology.

So how do insurance companies use location intelligence?

Insurers better understand where flood restoration, earthquake damage, and hurricane cleanup occur… All are location-based phenomena.

It’s all about predicting risk in the insurance industry. And insurance companies better manage risk with Geographic Information Systems.

Here are some prime examples of how GIS is revolutionizing insurance technology.

How do companies use insurance technology like GIS?

It wasn’t until very recently that insurance companies started to understand the benefits of GIS.

Location intelligence becomes relevant because insurance claims are 100% location-based.

Insurance technology like GIS brings to the fingertips of underwriters much quicker using real-time data to improve decision-making at a quicker pace.

But what are these real-time decisions?

1. Risk Assessment

Risk assessment uses geographic information to predict risk. Higher risk means higher premiums. Lower premiums are for areas with less risk. Insurance companies divide areas into territories. Risk assessors can determine risk in territories piece-by-piece.

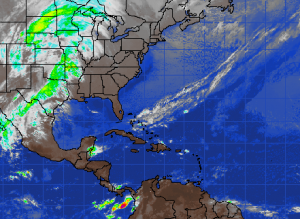

People living on a coastline in an area with hurricanes will pay higher premiums. We’ve mapped every hurricane in the past… And if the past is a good indicator of the future – then it’s a start.

2. Claims Management

Claims management involves processing claims concerning compensation, restoration, and repayment in response to loss or damage.

GIS assists in understanding where risk happens and where customer locations are. This is the proactive approach to responding to customers quickly and in an organized fashion.

3. Insurance Underwriting

Insurance underwriting evaluates risk and exposure for potential clients. The underwriting process decides the amount of coverage, cost, and even whether or not they should provide insurance for a client (or at all).

GIS enables targeted sales and marketing knowing that underwriters made the right decision. Who are they insuring? Where is the error proximity to the hazard? GIS insurance technology lets underwriters examine phenomena quickly and at a more granular level.

4. Insurance Fraud

Insurance fraud is a fraudulent claim usually for personal gain. Geospatial analytics can better understand addresses from start to finish. When the public knows another address gets a higher premium, it’s a misrepresentation to get a lower premium by falsifying an address.

On the claims side, GIS insurance technology can look at suspicious behavior with statistics. When you add the location to fraud investigation techniques, it’s a supplementary analysis to analyze opportunistic behavior for insurance claims.

Now, that we have a background on insurance, let’s go through some specific examples.

GIS in Insurance – Use Cases

1. Charging higher insurance premiums in flood-prone areas using radar

Have you ever noticed your home insurance premium skyrocket from the previous year? You might have to thank a geographer for that.

Insurance companies in Australia are using include radar and hydrological modeling. Geographers can map out areas more prone to flooding, how often these areas would flood, and how badly the damage could be.

The past approach was to assess risk by zip or postal code. Think about earthquakes and flooding. They don’t start at a postal code or administrative boundary.

The reality is:

Insurance companies are getting really good at determining risk because they hold a lot of risks.

One insurance company may divide the United States into 200,000 separate territories. Each territory assesses how much risk and how much of a premium to charge.

This is why insurance companies can offer such low premiums. GIS insurance technology obtains a more granular level of detail with a more holistic view of insurance risk assessments.

READ MORE: FEMA’s National Flood Hazard Layer contains regulatory flood hazard information in a Geographic Information Systems.

2. Monitoring driving habits with usage-based car insurance

Imagine being tested every day of your life in your driver’s seat. Car insurance technology equips your car with GPS and telematics equipment.

These GIS tools examine your driving habits every step of the way. For instance, what’s your driving speed? Do you suddenly accelerate or brake?

This is how car insurance companies can examine driver behavior and better estimate premiums.

This is the analytic granularity at its finest.

Further, insurers collect data from inside the vehicle and when the vehicle travels across a geographic boundary.

Geofencing is a virtual barrier in the real world. Understanding boundaries are crucial to providing alerts for car rental and car-share companies

3. Doing the detective work for fraudulent crop insurance claims

As the climate becomes less predictable and more destructive (such as droughts and floods), farmers have to adapt to this new reality.

In these cases, crop insurance can help farmers supplement their income when their fields don’t get seeded. Insurance companies and the United States Geological Survey (USGS) are teaming to up to fight crop insurance fraud.

The USGS measures vegetation growth using Landsat red, infrared channels in combination with NDVI.

Even after the fact that a claim is processed, you can verify claims using free Landsat-8 data available to the public online. Crop insurance companies gain the right tools to verify seeded crops and catch fraud.

READ MORE: Landsat Helps Fight Crop Insurance Fraud: Saving Millions in Government Dollars

4. Analyzing crowd-sourced data during natural disasters

From remote sensing to ground sensing, people are connected online with their mobile phones or devices.

Suddenly, we have people around the world sharing information constantly with one another through the internet.

In real-time, people report their experiences of an event as it happens. As such, this data can be very beneficial to insurance companies

Insurers use social media to capture hot spots from the true source of the event. This can add clarity, assist in allocating resources, and validate events.

When you put user-contributed content on a map, GIS can show social media in proximity away from an insured customer.

What’s Next?

The majority of data in insurance has a spatial component. Close to 100% of it, really.

Location intelligence and GIS insurance technology now become relevant in several areas …GIS has a lot to grow in the insurance industry

Think about the perils we are exposed to. Whether it’s earthquakes, flooding, or wind damage, the exact location becomes key and understanding the accumulation of risk.

The insurance industry expects to see more growth in geospatial information in insurance as major players are getting involved in the technology.

What are some interesting ways you’ve seen GIS used in the insurance business?

I would like to know more about how GIS can help life insurance businesses.

I would like to learn more on the topic

Need details and more info on the GIS in insurance. Specifically in property line of business.